Menu

Close

With Pazy elevate your accounts payable and spend management with unmatched precision, real-time insights, seamless integrations and custom pricing based on your needs

| Quickly see how Pazy and PayX stack up across essential business needs. | Pazy | PayX |

|---|---|---|

| Use Exisiting Current Account For Payments | X | |

| Multi-Line Item Parsing | X | |

| Real-Time Expense & Compliance Visibility | ||

| Customised Approval Workflows | ||

| Slack and WhatsApp Integration | X | |

| Tally and Zoho Books Integration | Advanced | Basic |

Pazy allows you to use your existing current bank accounts with HDFC, ICICI, Axis, Yes, RBL Banks.

Pazy accurately handles complex hand-written, multi line item invoices. Streamlining automated data entry and reducing manual errors.

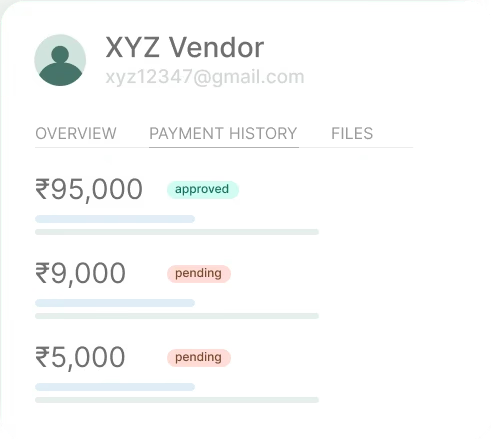

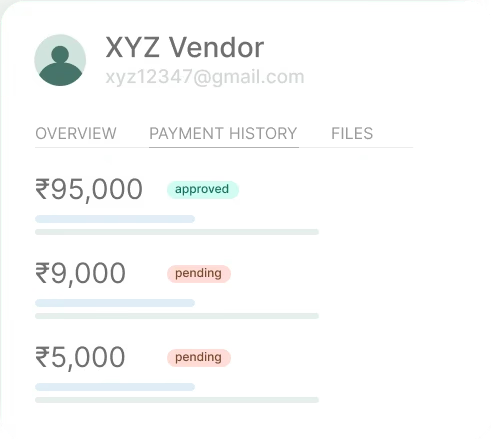

Pazy allows custom approval workflows based on your business needs, enhancing flexibility for complex organizational structures.

Simplifies invoice submission and approvals on tools where your employees are. Your team will love it.

Superior bill reading with OCR+AI technology, essential for enterprises tracking inventory, also dealing with substantial transaction volumes needing great accuracy.

Pazy simplifies business payment with bank partnerships, allowing you to use your current bank account and make immediate transactions. All within a single interface.

Pazy integration with Tally and Zoho Books is rock solid, in a click sync invoices and create Vouchers/Bills. Speeding up your book closing by 10x.

Since integrating Pazy, MDP Coffee House has achieved significant efficiency. Monthly financial closings are now completed in just two days—down from weeks. The real-time data integration reduced invoice processing errors by 30%, significantly enhancing our decision-making capabilities. This has been a game-changer for our business.

We had tried a lot of other tools before, some would excel on one thing or another. But none had robust integration with Tally as Pazy. We were up and running in 2 days, with other tools like Slack integrated to manage approvals. Our team members love it compared to mail-based systems.Highly recommend to check them out!

Pazy’s Advanced Invoice Parsing delivers over 95% accuracy, processing complex invoices quickly to reduce manual errors and save time, enhancing the reliability of your financial data.

Real-Time Financial Visibility provides instant access to your financial metrics and transaction data, enabling better decision-making and financial control.

Yes, Pazy seamlessly integrates with Slack and other business tools, streamlining communication and workflow automation across your organization.

Pazy offers flexible approval workflows that can be customized to match your organization’s hierarchy and business rules.

Direct invoice submission through WhatsApp or Slack simplifies the process, allowing quick and convenient invoice uploading from mobile devices or desktop platforms.